Not long ago, automated, high-frequency trading strategies were the exclusive domain of Wall Street firms and hedge funds with massive resources. Today, technology has leveled the playing field. An auto trading crypto bot makes these sophisticated capabilities accessible to everyone, from beginners looking to build a passive income stream to experienced traders wanting to optimize their workflow. By automating the execution of your strategy, these tools allow you to compete in a market that demands speed and consistency. They work around the clock, ensuring you never miss an opportunity just because you were sleeping, working, or spending time with family.

Principales conclusiones

- A Bot Executes Your Strategy, Not Creates It: A trading bot executes your plan with precision, but it doesn’t create the plan for you. Your success hinges on developing a solid strategy and providing smart oversight—the bot handles the execution, but you’re still the one in charge.

- Prioritize Security and Verified Performance: Focus on the fundamentals when selecting a bot: robust security, clear pricing, and a publicly verified track record. A proven history of performance in live markets is more valuable than any marketing promise and demonstrates a platform’s reliability.

- Balance Automation with Active Oversight: The most successful automated trading comes from partnership, not passivity. Regularly review your bot’s performance, refine your strategy based on data, and stay aware of market shifts. Your active oversight transforms the bot from a simple tool into a strategic asset.

What Are Auto Trading Crypto Bots?

If you’ve spent any time in the crypto space, you’ve probably heard about trading bots. They’re often pitched as a way to automate your trades and earn passive income, but it’s important to understand what they really are and how they fit into a trading strategy. Let’s break down the basics.

So, what exactly is a crypto trading bot?

Think of a crypto trading bot as a software program designed to interact with cryptocurrency exchanges and place trades on your behalf. It’s not a magic box that prints money, but rather a tool that executes a specific strategy with speed and precision. There are many reputable companies that develop these bots to give traders an edge. You are still the one in control, setting the rules and defining the strategy the bot will follow. The bot’s job is simply to carry out your instructions without getting tired or emotional, 24 hours a day.

How do they actually work?

At its core, a trading bot connects to your exchange account (like Binance or Coinbase) through something called an API key. This connection gives the bot permission to analyze market data and execute trades for you, but not to withdraw your funds. These automated systems execute trades based on pre-defined parameters you set. For simpler bots, this might mean buying Bitcoin when a certain price is reached. More advanced AI trading bots use data analysis, predictive modeling, and machine learning to identify potential trading opportunities based on market patterns and indicators, operating with minimal human intervention.

Why should you consider using one?

The main appeal of cryptocurrency trading bots is their ability to trade logically and consistently. They remove the emotional element—like fear or greed—that can lead to impulsive decisions. Because the crypto market operates 24/7, a bot can monitor prices and execute trades while you’re sleeping or at work. They also react to market changes much faster than a human can. While it’s true that bots can minimize errors like a mistyped order, they can’t eliminate the inherent risks of a volatile market. They are powerful tools for executing a well-planned strategy, not a shortcut to guaranteed profits.

The Must-Have Features in a Trading Bot

Not all trading bots are created equal. With so many options out there, it’s easy to get overwhelmed by technical jargon and flashy promises. To cut through the noise, focus on the core features that actually deliver results, security, and a user-friendly experience. Whether you’re a hands-on trader or looking for a set-it-and-forget-it solution, these are the non-negotiables to look for. A great bot isn’t just about automation; it’s about providing a complete, reliable system that works for you.

An interface you can actually use

The most powerful algorithm in the world is useless if you can’t figure out how to use it. A clean, intuitive interface is essential. You should be able to easily monitor performance, check your account status, and understand what the bot is doing without needing a degree in computer science. Look for a platform with a straightforward dashboard that presents key information at a glance. The goal is to have technology simplify your life, not complicate it. A well-designed system allows you to set up your account and let the bot execute its strategy, giving you peace of mind and saving you time.

Top-notch security measures

When your capital is on the line, security is paramount. A trustworthy trading bot provider will never ask for direct access to your funds. Instead, they should use secure connections like API keys to execute trades on your behalf at a brokerage. At FN Capital, we take this a step further by using a Third Party Fund Administrator (TPFA) structure. This means your funds are held with a regulated administrator, creating a secure barrier between our technology and your capital. This institutional-grade approach to mitigación de riesgos ensures your investment is protected while the AI does its work.

Connections to your favorite exchanges

A trading bot needs to connect seamlessly with the exchanges or brokers where you hold your funds. For crypto traders, this means integration with major exchanges like Binance or Kraken. For forex, it means connecting to highly-liquid, regulated international brokers. The quality of this connection impacts everything from execution speed to slippage. Our system is designed to give clients access to top-tier international brokers, ensuring efficient trade execution and optimal liquidity. This structure is a key advantage, allowing our FAST AI to perform under the best possible market conditions without the limitations often found at retail brokers.

Flexible strategy customization

The right bot should match your trading style. Some platforms offer tools to let you build and tweak your own strategies from the ground up. This is great for experienced traders who want granular control. However, for those who prefer a more hands-off approach, a bot with a proven, proprietary algorithm is a better fit. Our FAST AI algorithm is the result of years of development and refinement, designed to remove human emotion and guesswork from trading. Instead of building your own strategy, you can leverage our AI-powered trading solution that’s already optimized for performance and risk management.

The ability to backtest and paper trade

Would you buy a car without a test drive? The same logic applies to trading strategies. Backtesting allows you to see how a strategy would have performed on historical market data, giving you a clear picture of its potential strengths and weaknesses. While some platforms offer simulation tools, nothing beats a publicly verified track record. Our FAST AI algorithm has a four-year live performance record verified by FX Blue, a third-party service. This transparency allows you to see exactly how our system has performed in real market conditions over thousands of trades, offering confidence that goes beyond simple backtesting.

Built-in risk management tools

Profitable trading isn’t just about winning trades; it’s about managing losses. Any worthwhile bot must have robust, built-in risk management features. This includes fundamentals like setting stop-losses and managing position sizes. Advanced systems use dynamic tools that adapt to the market in real time. Our proprietary DART (Dynamic Algorithmic Risk Tool) is a core part of our system. It continuously analyzes market volatility and adjusts trade exposure and other risk parameters automatically. This AI-driven approach to mitigación de riesgos is designed to protect your capital during unpredictable market swings, a feature that’s critical for long-term success.

Real-time market analysis

The financial markets generate a staggering amount of data every second. Humans can’t possibly process it all, but AI can. A top-tier trading bot uses sophisticated algorithms to perform real-time market analysis, identifying patterns and opportunities that are invisible to the naked eye. By leveraging big data en la inversión, our FAST AI scans the EUR/USD pair for low-risk, high-probability setups with incredible speed and precision. This data-driven approach allows the bot to make informed decisions based on statistical probability rather than emotion or guesswork, giving it a significant edge in the market.

True 24/7 automated trading

The forex market runs 24 hours a day, five days a week, and the crypto market never closes. You can’t be at your screen all the time, but your bot can. True 24/7 automation is one of the biggest advantages of using a trading bot. It works for you while you’re sleeping, at your day job, or spending time with family. This ensures you never miss a potential opportunity, no matter what time zone it occurs in. For inversores minoristas, this creates a source of truly passive income, allowing your capital to work for you around the clock without constant manual oversight.

A Breakdown of the Top Crypto Trading Bots

Choosing a trading bot is a lot like picking a business partner—you need to find one that aligns with your goals, experience level, and strategy. Here’s a look at some of the most popular crypto trading bots on the market, so you can see which one might be the right fit for you.

Cryptohopper

Cryptohopper is a popular choice for traders who want a bot that’s easy to get started with but still packs a punch. It’s designed to take the emotion out of trading by automating your strategy 24/7. You can connect it to your favorite crypto exchanges and let it do the work. One of its standout features is the marketplace, where you can buy and sell trading strategies, which is great if you’re not ready to build your own from scratch. It also offers paper trading, so you can test your ideas without risking real funds. Cryptohopper supports a wide range of cryptocurrencies and provides tools for backtesting, making it a solid all-around platform for both new and experienced traders.

3Commas

3Commas is another heavyweight in the crypto bot space, known for its versatility and powerful features. It’s more than just a bot; it’s a full trading terminal that helps you manage your portfolio across multiple exchanges from one dashboard. The platform offers several types of bots, including the popular DCA (Dollar-Cost Averaging) and Grid bots, which are great for accumulating assets or trading in sideways markets. You can also use its SmartTrade feature to set up trades with simultaneous take-profit and stop-loss orders. 3Commas aims to help you implement complex strategies automatically, making it a fantastic tool whether you’re just starting out or have been trading for years.

HaasOnline

If you’re an experienced trader looking for deep customization, HaasOnline is likely on your radar. This platform is built for those who want granular control over their trading strategies. It offers a suite of advanced, pre-built bots but truly shines with its custom bot designer, which lets you create complex automated strategies without needing to code. HaasOnline also provides robust backtesting and paper trading engines to fine-tune your approach before going live. It’s a more technical platform compared to others on this list, making it a better fit for serious traders who understand market mechanics and want to build highly specific, proprietary trading systems.

Pionex

Pionex takes a different approach by being an exchange with built-in trading bots. This integration means you don’t have to worry about connecting to a third-party exchange via API keys. The platform offers over 16 free, pre-configured bots, including the popular Grid Trading Bot and Leveraged Grid Bot. Since the bots are free to use, you only pay the standard trading fees on the exchange, which are quite competitive. This makes Pionex an incredibly accessible option for beginners who want to experiment with automated trading without committing to a monthly subscription. It’s a simple, all-in-one solution for getting your feet wet in the world of crypto bots.

Bitsgap

Bitsgap is a comprehensive platform that brings trading, bots, and portfolio management under one roof. It connects to over 15 major crypto exchanges, allowing you to manage all your assets from a single interface. Its signature feature is the high-performing Grid Bot, which is designed to profit from market volatility by placing a series of buy and sell orders. Bitsgap also offers arbitrage opportunities by scanning for price differences across exchanges. With a clean interface and a demo mode to practice, it’s a strong contender for traders of all skill levels who want a powerful, unified tool for their crypto activities.

Shrimpy

Shrimpy is geared more toward long-term investors than high-frequency traders. Its core feature is automated portfolio rebalancing, which helps you maintain your desired asset allocation over time. You can set a target percentage for each crypto in your portfolio, and Shrimpy will automatically execute trades to keep it balanced. It also has a social trading component, allowing you to copy the portfolios and strategies of more experienced investors. If your goal is to build and manage a diversified crypto portfolio with a “set it and forget it” approach, Shrimpy is an excellent choice. It simplifies long-term strategy and takes the manual work out of portfolio management.

TradeSanta

TradeSanta is designed with simplicity in mind, making it a great entry point for newcomers to automated trading. It’s a cloud-based platform, so you don’t need to install any software, and it runs 24/7. You can choose from long or short strategies and use pre-configured templates to get started quickly. The platform offers Grid and DCA bots, along with technical indicators like RSI and MACD to trigger trades. TradeSanta provides a straightforward user interface and a helpful wizard to guide you through the bot setup process. It’s a solid, accessible option for anyone who feels intimidated by more complex platforms but still wants to automate their trading.

Coinrule

Coinrule empowers traders to build their own automated strategies without writing a single line of code. It uses a simple “If-This-Then-That” logic that feels intuitive, even for complete beginners. For example, you can create a rule like, “IF the price of BTC drops by 5%, THEN buy $100 worth.” The platform offers over 150 templates to help you get started, covering strategies from accumulation to trend-following. Coinrule connects to major exchanges and allows you to run multiple rules simultaneously. It’s the perfect tool for creative traders who have specific strategies in mind but lack the technical skills to program a bot from scratch.

Kryll

Kryll stands out with its highly visual, drag-and-drop strategy editor. Instead of writing rules, you build trading logic by connecting blocks that represent different actions and indicators. This makes the process of creating a custom strategy feel more like building a flowchart, which can be very intuitive for visual thinkers. Like other platforms, Kryll features a marketplace where you can rent strategies from other users or lease out your own successful bots. The platform operates on a “pay-as-you-go” model, where you only pay for what you use, making it a flexible option if you don’t want to commit to a monthly subscription.

Quadency

Quadency aims to be your all-in-one crypto trading headquarters. It provides a unified interface to trade on multiple exchanges, track your entire portfolio, and deploy automated bots. The platform comes with a library of pre-built bots, including a Grid Trader and a Portfolio Rebalancer, that are easy to configure and launch. For more advanced users, it offers a strategy coder to build custom bots. One of its best features is the dashboard, which gives you a clear, consolidated view of your performance across all connected accounts. Quadency is a robust solution for traders who want powerful automation combined with smart portfolio management tools.

How to Tell if Your Bot Is Actually Working

Once you’ve chosen a bot and set it loose, the real work begins. It’s tempting to adopt a “set it and forget it” mindset, but the most successful traders know that a bot is a tool, not a magic money printer. While automated systems execute trades based on their programming, they still require your oversight. Think of yourself as the manager, not just a passive observer. Your job is to understand if the bot is performing as expected, sticking to its strategy, and managing risk effectively.

The good news is you don’t need to be glued to your screen 24/7. Instead, you need to know what to look for and how to interpret the data. By regularly checking a few key indicators and understanding the reports, you can get a clear picture of your bot’s health and make informed decisions about its strategy. This is how you combine the bot’s tireless execution with your own strategic insight to get the best results.

Key metrics to watch

When you first look at a performance dashboard, it’s easy to focus only on the total profit or loss. But to truly understand how your bot is doing, you need to look a little deeper. Start with the win rate, which is the percentage of trades that close in profit. Next, look at the risk-to-reward ratio, which tells you how much profit the bot aims for on each trade compared to how much it’s willing to lose. A system like FN Capital’s FAST AI, for example, maintains a 2:1 ratio, targeting twice the potential gain for every unit of risk.

Another critical metric is the max drawdown. This shows you the largest percentage drop your account has experienced from a peak. It’s a realistic indicator of the risk involved and helps you gauge your own comfort level. Finally, look for a consistent average monthly return to ensure the performance is steady, not just the result of a few lucky trades.

How to monitor performance in real time

Checking in on your bot should be a calm, scheduled activity, not a frantic, emotional reaction to market swings. Most quality platforms provide a real-time dashboard where you can see your profit and loss (P/L) at a glance. This is your command center. For FN Capital clients, this is handled through the TPFA dashboard, giving you a clear and immediate view of the AI’s activity. You can see open positions, closed trades, and your overall account balance without getting overwhelmed.

Beyond the main dashboard, take a look at the trade history or execution logs. This lets you see exactly what the bot is doing. Are the trades aligning with the strategy you chose? Is the frequency of trades what you expected? This kind of análisis de inversiones helps you build confidence in the system and confirm that the bot is operating within its designated parameters.

Why backtesting results matter

Backtesting is the process of testing a trading strategy on historical market data to see how it would have performed in the past. While it’s true that past performance doesn’t guarantee future results, it’s an absolutely essential step in due diligence. It helps you set realistic expectations and understand how a strategy might behave during different market conditions, like high volatility or a sideways trend. A solid backtest can reveal potential weaknesses in a strategy before you risk a single dollar of your own money.

Think of it as a strategy’s resume. A bot with a long and publicly verified track record is demonstrating its consistency and resilience over time. FN Capital’s 4-year verified performance on FX Blue is a perfect example of this—it’s not just a hypothetical backtest but a live, transparent history of how the FAST AI has actually performed through years of real market changes.

Making sense of analytics and reports

All the metrics and data points come together in your analytics reports. This is where you connect the dots and see the bigger picture of your bot’s performance. A good report will combine data analysis with clear visuals, allowing you to assess the strategy without needing a degree in quantitative finance. Look for consistency in the returns and how the bot manages risk over time. Is the equity curve a steady upward climb, or is it a volatile rollercoaster?

The most trustworthy platforms take this a step further by offering transparent, third-party verified reporting. This removes any doubt about the authenticity of the results. When you can view a live track record on a neutral platform like FX Blue, you know the numbers are real. This level of transparency is crucial because it proves the system’s mitigación de riesgos and performance are not just marketing claims but verifiable facts.

Understanding the Costs: What to Expect

When you start looking at trading bots, you’ll see that the pricing is all over the map. Some platforms charge a monthly fee, others take a small slice of each trade, and some have a one-time license cost. There’s no single “best” model—it all comes down to finding the one that aligns with your trading style, frequency, and budget. The goal is to find a transparent partner so you know exactly what you’re paying for and can accurately calculate your potential returns.

Before you commit, it’s smart to map out the total cost. This includes not just the platform’s fee but also any trading fees from the exchange itself. A bot that seems cheap upfront might end up costing you more in the long run if its fee structure doesn’t match your strategy. Let’s break down the common pricing models you’ll encounter so you can make a well-informed choice.

Subscription-based plans

This is probably the most common pricing structure you’ll find. Platforms will offer several subscription tiers, often starting with a free but limited plan and scaling up to more expensive “pro” or “expert” levels. A free plan might let you run one bot on a single exchange, while a premium plan could give you access to dozens of bots, advanced strategies, and priority support.

The key is to look past the price tag and examine what you get with each tier. Don’t pay for features you won’t use. If you’re just starting, a basic plan is likely all you need. As you become more experienced, you can always upgrade. Some platforms also offer annual billing for a discount, which is a great way to save money if you’ve found a bot you love. For a different approach, some providers offer a straightforward license fee that gives you long-term access without recurring monthly charges.

Commission structures

Instead of a flat monthly fee, some platforms charge a small commission on your trades. This “pay-as-you-go” model can be really appealing, especially if you’re not a high-volume trader. You only pay when the bot is actively making money for you, which feels fair and low-risk. Platforms like Pionex have built their model around this, offering free built-in bots and only charging a tiny fee per trade.

However, if you plan on running a high-frequency strategy, these small commissions can add up fast and start to eat into your profits. It’s a good idea to estimate your potential trading volume before choosing this model. For serious comercio cuantitativo, a fixed subscription or license fee often becomes more cost-effective over time, as your costs remain predictable no matter how many trades your bot executes.

Watch out for hidden fees

No one likes surprise charges. While most bot platforms are upfront about their pricing, you still need to do your homework. The subscription or commission fee is just one piece of the puzzle. You also have to account for the trading fees charged by the crypto exchange itself, which the bot platform has no control over. Some platforms might also have less obvious costs, like higher fees for using their marketplace signals or a performance fee that takes a percentage of your profitable trades.

Always read the terms of service carefully. Look for a provider that values transparency and clearly outlines all potential costs on their website. A company confident in its performance will make its results and fee structure easy to find and understand, much like a publicly historial verificado does. This level of openness is a great sign that you’re dealing with a reputable platform.

Finding current promotions and free trials

The best way to know if a bot is right for you is to try it yourself. Many platforms offer a free trial, giving you a chance to test their features, connect to your exchange, and see how the interface feels without spending a dime. These trials are your best friend when you’re comparison shopping. You can run a few different bots in a paper trading mode to see which one performs best with your strategy before committing any real capital.

Keep an eye out for these offers—they’re a fantastic, risk-free way to get started. Some companies take this a step further by offering a full money-back guarantee, which shows incredible confidence in their product’s ability to perform. When you’re ready to test the waters, you can crear una cuenta and see if the platform offers a trial or a satisfaction guarantee to begin your evaluation.

Common Risks and Misconceptions (and How to Handle Them)

Let’s be real: while trading bots are incredibly powerful, they aren’t a magic wand for instant, risk-free wealth. Like any sophisticated tool, they come with their own set of risks and common misunderstandings. The key isn’t to avoid them but to understand them so you can handle them like a pro. Getting ahead of these challenges is what separates a smart, strategic investor from someone just hoping for the best.

Thinking through these potential hurdles beforehand will help you choose the right tool and set realistic expectations for your trading journey. It’s all about pairing powerful automation with your own informed oversight. When you know what to look for, you can confidently use a bot to work toward your financial goals without getting tripped up by surprises. Let’s walk through some of the most common concerns and how to approach them.

Handling market volatility

The forex market is famous for its volatility, and no algorithm can completely erase that inherent risk. A bot can execute trades perfectly based on its programming, but it can’t predict a sudden market crash or a surprising global event. The idea that a bot makes trading risk-free is a dangerous myth. Instead, the goal is to use a tool that manages volatility intelligently. A great bot won’t eliminate risk, but it will react to it based on a sound, data-driven strategy.

This is where a system with built-in, dynamic risk mitigation becomes essential. For example, FN Capital’s FAST AI includes a tool called DART (Dynamic Algorithmic Risk Tool) that continuously analyzes market conditions. It automatically adjusts trade sizes, leverage, and exposure in real time to protect your capital during turbulent periods.

What to do about technical glitches and bot errors

Automated systems are fantastic until they hit a snag. A poorly coded bot or an unstable platform can lead to missed trades, bad executions, or other errors, especially during unexpected market conditions. If the system you rely on isn’t robust, you could face issues that have nothing to do with your strategy and everything to do with faulty tech. This is why trusting your capital to a proven, professionally maintained platform is non-negotiable.

Look for systems with a long, publicly verified history of performance. A transparent track record not only shows that the strategy works but also proves the platform’s stability and reliability over thousands of trades. Institutional-grade infrastructure ensures the bot operates smoothly, executing trades precisely as intended without being derailed by technical hiccups.

The myth of “guaranteed profits”

If you see a trading bot promising “guaranteed profits,” your best move is to run in the other direction. The allure of never missing a profitable trade is strong, but it’s just not realistic. No trading bot, no matter how advanced, can guarantee returns. The market is far too complex and unpredictable for that. This myth often leads new traders to take unnecessary risks or become discouraged when results aren’t instantaneous.

A much healthier approach is to focus on consistent, verified performance over time. Instead of chasing guarantees, look for a realistic, data-backed average return. For instance, FN Capital’s FAST AI has a four-year verified track record showing an average monthly return of 7.5%+. This isn’t a guarantee, but it’s a transparent performance metric you can use to set practical goals.

Why your bot still needs you

One of the biggest misconceptions is that you can just turn on a bot and completely forget about it. While systems like FAST AI are designed to be fully autonomous, that doesn’t mean your role disappears—it just changes. You’re no longer the one clicking the buttons, but you are the strategist overseeing the entire operation. Your job is to set the initial goals, choose the right tool for your risk tolerance, and monitor its performance over time.

Think of yourself as the CEO and the bot as your expert trading team. You provide the capital and the high-level direction, and the bot handles the moment-to-moment execution. For retail investors, this means you can step away from the charts while still ensuring the automated system is aligned with your long-term financial objectives.

How to Choose the Right Bot for You

Picking the right trading bot feels a lot like hiring a new team member. You wouldn’t bring someone on without knowing what you want them to accomplish, what skills they need, how much you can pay them, and how you’ll work together. The same logic applies here. The “best” bot isn’t a one-size-fits-all solution; it’s the one that aligns perfectly with your personal financial goals and trading style.

Before you get lost in a sea of features and pricing plans, take a step back and focus on what truly matters. Your decision should come down to four key things: your trading goals, your experience level, your budget, and the amount of time you’re willing to commit. By clarifying these points first, you can cut through the noise and find a tool that genuinely works for you. This approach helps you select a system that supports your strategy, whether you’re looking to automate a complex plan or simply build a source of passive income.

Define your trading goals

First things first: what are you trying to achieve? Simply saying “make money” isn’t specific enough. Are you aiming for slow and steady portfolio growth, or are you chasing aggressive, short-term gains? Are you looking to diversify your assets with a hands-off strategy, or do you want to actively day trade without being glued to your screen? Your goals will determine the type of bot and strategy you need. A bot is a powerful tool, but it still needs direction. Your strategy and goals are the guiding force behind its operations. For instance, if your primary goal is to add a consistent, automated return stream to your portfolio, a solution like FAST AI could be a perfect fit for your alternative investments strategy.

Match the bot’s features to your experience level

Be honest about your comfort level with trading and technology. If you’re new to the markets, you’ll want a bot with a clean, intuitive interface and perhaps some pre-built strategies to get you started. The last thing you need is a complicated dashboard that feels like you need an engineering degree to use. On the other hand, if you’re a seasoned trader, you might want advanced features like deep strategy customization and detailed analytics. While a good bot can minimize simple errors, it can’t eliminate the inherent risks of the market. Find a platform that matches your skill set. Many modern solutions, including ours, are designed to be accessible to retail investors while still offering the power that professionals demand.

Factor in your budget

Trading bots come with a variety of pricing models, from monthly subscriptions to one-time license fees and commission-based structures. It’s easy to be tempted by a free or low-cost option, but remember that you often get what you pay for. A poorly designed bot can be far more costly in the long run than a premium subscription. Look for transparent pricing without hidden fees. Think of it as an investment in a reliable tool. Some of the best platforms align their success with yours, for instance, by offering a money-back guarantee. This shows confidence in their product and gives you a chance to verify performance. You can review our pricing and license options to see how a clear, value-focused structure works.

Think about your long-term commitment

How much time and energy can you realistically dedicate to managing your bot? Some bots are like high-maintenance sports cars—they require constant tinkering, monitoring, and strategy adjustments to perform well. Others are more like a reliable daily driver, designed for autonomous, hands-off operation. If you have a full-time job and a busy life, you probably want a “set it and forget it” solution that works for you in the background. Even with a fully automated system, it’s smart to periodically check in on performance. Having access to a long-term, historial verificado can give you the confidence to let the system work without feeling the need to micromanage it every day.

Your First Steps with an Auto Trading Bot

Alright, you’ve chosen a bot and you’re ready to get started. This is where the real work—and the real fun—begins. Getting your bot up and running isn’t just a one-click process. It’s about thoughtfully setting it up for success, giving it a clear plan, and keeping a watchful eye on its performance. Think of yourself as the mission director and the bot as your astronaut; you need to give it the right instructions and monitor the flight. Let’s walk through the three key phases to get you from setup to smart, automated trading.

Set up and configure your bot

First things first, you need to connect your bot to your crypto exchange account. This is usually done using something called an API key, which allows the bot to place trades on your behalf without having direct access to your funds for withdrawals. Once connected, the real configuration begins. This is your chance to translate your market knowledge into a set of rules for the bot. You’ll define things like which crypto pairs to trade, how much capital to allocate per trade, and what indicators should trigger a buy or sell. This initial setup is your foundation, so take your time to get it right. It’s the first step in building your own system for comercio cuantitativo.

Implement your initial strategies

With your bot configured, it’s time to give it a job to do. Your strategy is the set of pre-defined parameters the bot will use to execute trades automatically. If you’re new to this, it’s wise to start with a straightforward, well-understood strategy. Many bots come with pre-built templates for things like grid trading or dollar-cost averaging (DCA), which can be great starting points. The key is to begin with a plan that is clear and easy to monitor. Avoid the temptation to create a complex, multi-indicator strategy from day one. Your goal here is to get the bot trading based on a simple hypothesis you can test and understand.

Monitor and adjust performance as you go

This is probably the most important step and the one people most often forget. A trading bot is not a “set it and forget it” money machine. The crypto market is incredibly dynamic, and a strategy that works well one week might struggle the next. You need to regularly check in on your bot’s performance. Is it hitting its profit targets? Are the stop-losses working as expected? Don’t be afraid to pause the bot, tweak your parameters, or even switch strategies if the data shows it’s not performing well. Constant monitoring is a core part of any sound mitigación de riesgos plan and is essential for protecting your capital over the long term.

Smart Habits for Long-Term Success

Getting your auto trading bot running is an exciting first step, but the real work lies in building a sustainable approach for the long haul. The most successful traders don’t just “set it and forget it.” Instead, they treat their bot as a powerful partner, combining its automated precision with their own strategic direction. This partnership is built on a foundation of continuous learning and mindful oversight.

Think of it this way: the bot is your tireless employee, executing tasks with speed and accuracy you could never match manually. But you are the CEO, setting the vision, defining the goals, and making the key strategic decisions. Cultivating a few smart habits will ensure this partnership thrives, helping you move toward your financial goals with confidence and control. Let’s walk through the three most important habits for achieving long-term success with automated trading.

Keep learning and refining your strategy

The financial markets are constantly evolving, and the strategy that worked yesterday might not be the best fit for tomorrow. Your bot is only as effective as the instructions you give it. That’s why it’s so important to continuously learn and refine your approach. As experts note, traders need to infuse their own expertise and strategic foresight into their bot’s operations to guide them effectively. This means staying curious and treating every trade as a learning opportunity.

Regularly review your bot’s performance and ask critical questions. Which trades were most successful and why? Did any patterns emerge? Use these insights to fine-tune your settings or test new parameters. A deep análisis de inversiones helps you understand the story behind the numbers, turning raw data into actionable intelligence. Your knowledge is the engine that drives the bot forward, so never stop learning.

Balance automation with your own oversight

While it’s true that bots can minimize common human errors, they don’t eliminate the inherent risks of a volatile market. Handing over the execution of your trades doesn’t mean giving up control. True confidence comes from balancing the bot’s automation with your own thoughtful oversight. This isn’t about micromanaging every single action but about setting clear, intelligent boundaries for your bot to operate within.

Your primary role is to define your risk tolerance and translate it into rules for your bot. This includes setting stop-losses, determining position sizes, and deciding how much capital to allocate. Systems with built-in mitigación de riesgos tools are designed for this very purpose, allowing you to automate your strategy while protecting your capital. Periodically check in to ensure the bot is performing as expected and remains aligned with your overall financial goals.

Stay informed about market trends

Modern AI trading bots are brilliant at combining data analysis and predictive modeling to execute trades with minimal human intervention. They can process millions of data points in the blink of an eye, but they can’t read the news or understand the nuances of human sentiment. That’s where you come in. Staying informed about broader market trends gives you the context your bot lacks, allowing you to make smarter, more proactive decisions.

Major economic announcements, regulatory shifts, or changes in geopolitical stability can all impact the market. By keeping an eye on these tendencias mundiales de inversión, you can anticipate potential volatility and adjust your bot’s strategy accordingly. For example, you might decide to pause your bot during a period of high uncertainty or adjust its parameters to be more conservative. This blend of AI-driven execution and human-led foresight is a powerful combination for long-term success.

What’s Next for Automated Crypto Trading?

The world of automated trading is constantly evolving, and crypto bots are at the forefront of that change. As technology gets smarter and markets become more complex, the tools we use are adapting right alongside them. Staying aware of these shifts is key to making informed decisions and refining your strategy over time. The future isn’t about finding a “set it and forget it” solution, but about understanding the trends that will shape how we trade tomorrow. From smarter AI to a clearer regulatory picture, here’s a look at what’s on the horizon for automated crypto trading.

The role of AI and emerging technologies

The next generation of trading bots is being driven by artificial intelligence. While older bots rely on pre-set “if-then” rules, AI-powered systems are designed to learn and adapt. As Coin Bureau notes, “AI trading bots combine data analysis, predictive modeling, and automated execution to operate across financial markets with minimal human intervention.” This means they can analyze massive datasets, identify subtle patterns, and make predictive decisions that go far beyond basic technical indicators. Systems like FN Capital’s FAST AI are a great example of this, using big data en la inversión to execute trades based on deep market intelligence. Expect to see more bots that use machine learning to refine their strategies in real time, adjusting to volatility and new market conditions without needing you to step in and manually change the parameters.

What to expect from regulations

As crypto becomes more mainstream, regulatory conversations are getting louder. For now, the rules around bot trading are fairly straightforward. According to Dash 2 Trade, “Using crypto trading bots is generally legal in most countries if cryptocurrency trading itself is legal there.” However, the landscape is always changing, so it’s your responsibility to stay informed about the laws in your specific region. Reputable bot providers and exchanges prioritize compliance, but you should always do your own research. As the industry matures, we can likely expect clearer guidelines, which will help legitimize the space and weed out bad actors. This move toward structure and transparency is a positive step, creating a safer environment for everyone involved in alternative investments.

How bots are changing the crypto market

Crypto bots are fundamentally changing the market by making sophisticated trading strategies accessible to more people. They level the playing field, allowing individual traders to execute strategies that were once only available to large financial institutions. As Blockspot points out, “bots can minimize errors such as mistyped trade values or missed trading windows,” which brings a higher degree of precision to trading. However, it’s crucial to remember they “can’t eliminate the inherent risks of the volatile crypto market.” The most significant impact of bots is their ability to enhance efficiency and remove emotion from the equation. By automating execution based on a sound, data-driven strategy, they help traders stick to their plans and avoid making impulsive decisions, which is a cornerstone of any successful mitigación de riesgos approach.

Artículos relacionados

- Bots de Trading Automatizados: Su guía definitiva

- Día de comercio Bots: Beneficios, Riesgos y Cómo Funcionan

- Bot Trading Apps: How They Work & Top Picks

- 9 Best Crypto Trading Bots (2024 Review)

- Los 5 mejores bots de trading de criptomonedas para principiantes en 2024

Preguntas frecuentes

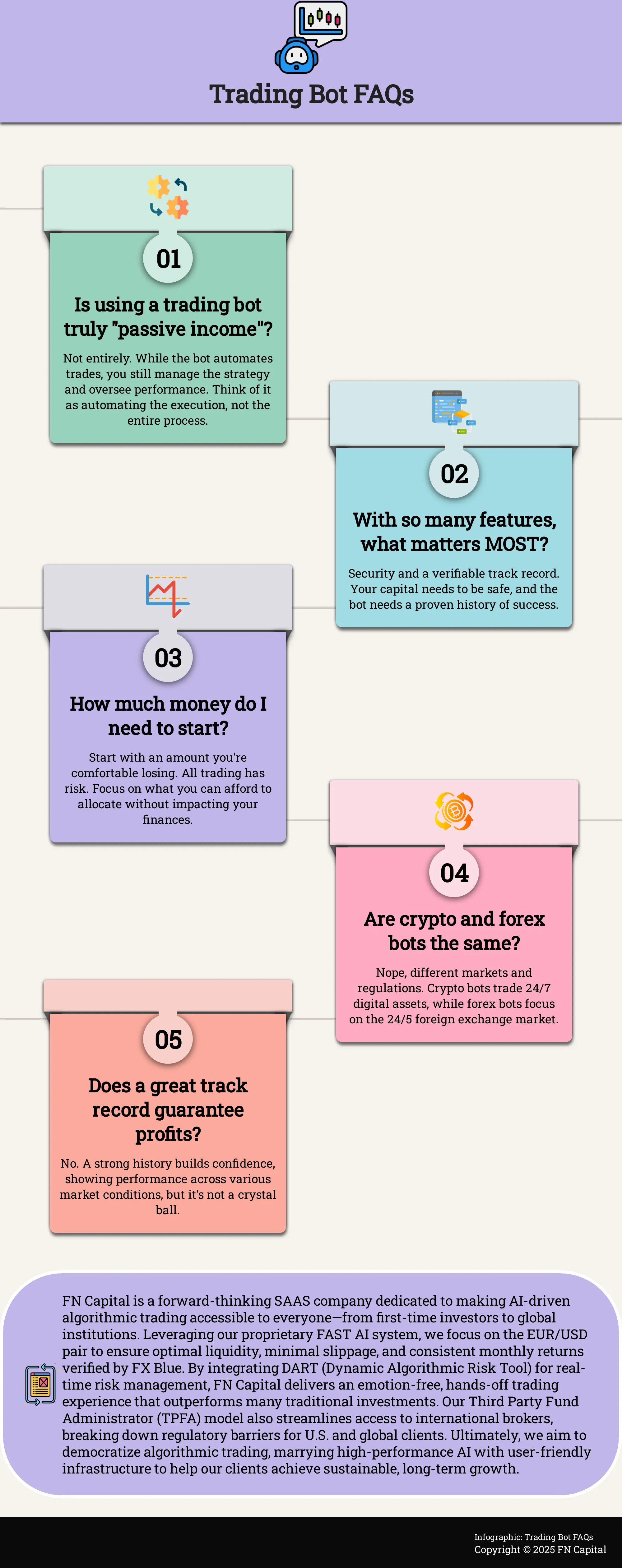

Is using a trading bot really “passive income” if I still have to monitor it? That’s a great question, and it gets to the heart of using these tools smartly. Think of it this way: the “passive” part refers to the trade execution, not your overall strategy. The bot handles the tedious, 24/7 work of watching the charts and placing orders with perfect precision, freeing you from being tied to a screen. Your role shifts from being a manual trader to being a manager. You still set the direction, define the risk, and check in on performance, but you get to do it on your own schedule.

With so many features, what’s the most important thing to look for in a trading bot? While a slick interface and lots of strategy options are appealing, they aren’t the most critical factors. The two absolute non-negotiables are security and a transparent, verifiable performance history. First, the system must protect your capital through secure connections and structures, never requiring direct access to your funds. Second, it needs to prove its strategy works in the real world, not just in theory. A publicly verified track record shows you exactly how the system has performed over time, which is the best evidence you can ask for.

How much money do I actually need to get started with a trading bot? There isn’t a single magic number, as it depends on the bot’s fee structure and the minimum trade sizes on your chosen exchange. However, the most important rule is to only start with an amount you are fully prepared to lose. All trading carries inherent risk, and a bot doesn’t change that. Instead of focusing on a specific dollar amount, think about what capital you can comfortably allocate to a new strategy without it affecting your financial well-being.

The blog mentions crypto and forex bots. Are they basically the same thing? While both use automation to trade, they operate in very different environments. The core technology might be similar, but the markets, strategies, and regulatory structures are distinct. Crypto bots trade on 24/7 digital asset exchanges, while a specialized forex bot like FN Capital’s FAST AI focuses on the 24/5 foreign exchange market. Our system, for example, concentrates exclusively on the EUR/USD pair for maximum liquidity and uses a specific legal structure with a Third Party Fund Administrator (TPFA) to give clients access to top-tier international brokers.

If a bot has a great track record, does that mean it’s a sure thing? A strong, long-term track record is an excellent sign, but it is not a guarantee of future results. No one can predict the market with 100% certainty. What a verified history does provide is confidence. It shows you how a strategy has performed through various market conditions—ups, downs, and sideways trends. It proves the system is resilient and that its performance isn’t just a short-term fluke. It’s about making an informed decision based on historical evidence, not a promise of guaranteed profits.