For decades, the most powerful trading tools were locked away in the towers of Wall Street, accessible only to large hedge funds and financial institutions. That era is over. The rise of AI-powered platforms has leveled the playing field, bringing institutional-grade technology directly to individual investors. This shift means you no longer need a team of quantitative analysts to build a sophisticated, automated trading strategy. The challenge now is navigating this new world of options. This article will serve as your guide, breaking down what makes a platform effective, what to look for in terms of performance, and how to choose the right tool for your financial goals, helping you identify the best AI for traders in this democratized market.

Key Takeaways

- Remove Emotion from the Equation: The greatest advantage of AI trading is its ability to operate on pure data and logic. This removes the costly mistakes driven by fear and greed, helping you stick to a disciplined and consistent strategy.

- Demand a Verifiable Track Record: Don’t rely on marketing claims alone. The most trustworthy platforms provide a transparent, publicly verified performance history, which is the best evidence you have of a strategy’s real-world effectiveness.

- Align the Tool with Your Trading Style: The right platform is the one that fits your personal goals. First, decide if you want a hands-off system for passive income or an AI assistant for active trading, then choose a tool built specifically for that purpose.

What is AI Trading (And Why Does It Matter)?

So, what exactly is AI trading? At its core, it’s the practice of using artificial intelligence to make and execute trading decisions. Instead of a person manually watching charts and placing orders, sophisticated software analyzes market data, identifies potential opportunities, and acts on them automatically. Think of it as having a data-driven expert working for you 24/7, without the emotional highs and lows that can lead to impulsive choices. This technology uses complex algorithms and machine learning to process information far beyond human capacity, aiming for precision and consistency in the fast-paced world of trading.

Now, why should this matter to you? Because AI isn’t just a futuristic concept—it’s already the engine driving the majority of the market. In fact, some reports show that AI is behind a significant portion of global trading volume, using advanced algorithms to automate trades and predict price movements. This shift is significant because AI can analyze millions of data points in milliseconds, from news sentiment to historical price patterns, to find low-risk, high-probability setups. It operates with a level of speed and analytical depth that’s simply impossible for a human trader to replicate.

Perhaps the most exciting part is that these powerful tools are no longer reserved for massive hedge funds on Wall Street. The rise of AI-driven platforms is leveling the playing field, bringing what was once exclusive institutional trading technology directly to individual investors. This means you can access strategies built on efficiency, accuracy, and speed without needing a PhD in quantitative finance. It democratizes the market, allowing everyday investors and seasoned professionals alike to use the same caliber of technology to build their portfolios.

However, it’s important to know that not all AI trading tools are created equal. While the technology has become more accessible, the quality can vary dramatically. The most effective AI systems rely on vast, high-quality datasets and sophisticated risk management protocols. Unfortunately, access to high-quality data and truly advanced tools can still be a barrier, sometimes putting retail traders at a disadvantage. This is why choosing the right platform is so critical. You need a system with a proven track record, transparent performance, and built-in risk controls to truly harness the power of AI.

What to Look For in an AI Trading Platform

When you start exploring AI trading, you’ll quickly realize that not all platforms are built the same. The right one for you depends entirely on your financial goals, how hands-on you want to be, and your tolerance for risk. Some systems are designed for you to build and test your own strategies, while others offer a fully automated, “set-it-and-forget-it” experience. To find a platform that truly works for you, it helps to know which core features make a real difference. These are the key components that separate a powerful AI trading tool from a basic one.

Predictive Analytics

At its core, a great AI trading platform is a forecasting powerhouse. It should use sophisticated algorithms and machine learning to analyze massive datasets and predict potential price movements. This is what gives you an edge. Instead of relying on gut feelings or manual chart analysis, the AI identifies patterns and probabilities that are invisible to the human eye. According to some industry analyses, AI now drives a significant portion of global trading volume by using this predictive power to stay ahead of market shifts. Look for a platform that is transparent about its use of predictive models to find low-risk, high-probability opportunities.

Automated Execution

A prediction is useless if you can’t act on it quickly. That’s where automated execution comes in. The best AI platforms don’t just send you alerts; they execute trades on your behalf instantly. This removes the delay and emotional hesitation that often costs manual traders money. This level of efficiency and speed, once reserved for large financial institutions, is now accessible to everyone. These AI-driven strategies connect directly to your broker, ensuring that when the AI identifies an opportunity, it acts on it in real-time, 24/5. This hands-free approach is perfect for anyone seeking a more passive way to participate in the markets.

Built-In Risk Management

Making money is only half the battle; protecting your capital is just as important. A top-tier AI trading platform must have robust, built-in risk management tools. This isn’t just a simple stop-loss; it’s a dynamic system that actively manages your exposure based on real-time market conditions. Features like automatically adjusting position sizes or trailing stop-losses help lock in gains and minimize losses without you having to watch the screen. The goal is to automate technical analysis and order flow to protect your investment from unexpected volatility, ensuring the AI trades smartly, not just frequently.

Real-Time Data Analysis

The financial markets generate an overwhelming amount of data every second. No human can possibly keep up. This is where AI truly shines. A powerful platform can process and analyze market data, news sentiment, and economic indicators in real time. This capability has completely changed the quality and speed of data analysis available to the average trader. Instead of reacting to yesterday’s news, the AI makes decisions based on what’s happening right now. This ensures your trading strategy is always informed by the most current information available, giving you a significant advantage.

Strategy Customization and Backtesting

Trusting an AI with your money requires confidence in its strategy. The best platforms provide ways to verify performance. For traders who like to be in control, this often means tools for strategy customization and backtesting. Backtesting allows you to test a trading idea against historical market data to see how it would have performed. For those who prefer a ready-made solution, look for platforms that offer a publicly verified track record. This provides transparent, third-party proof that the AI’s strategy has been successful over a long period, giving you the confidence to let it work for you.

The Best AI Trading Platforms on the Market

Finding the right AI trading platform feels a lot like picking a business partner. You need one you can trust, one that understands your goals, and one that has the right skills for the job. The market is filled with options, each with its own specialty. Some are built for the fast-paced world of forex, others are designed to scan the stock market for hidden gems, and many focus exclusively on the 24/7 crypto market. Your ideal platform depends entirely on what you trade, how involved you want to be, and your overall investment strategy.

Are you looking for a completely hands-off system that executes trades for you? Or do you prefer a tool that provides deep analysis and pattern recognition to inform your own decisions? Some platforms offer sophisticated bots that follow pre-set rules, while others use advanced AI to predict market movements. We’ve gathered a list of the top AI trading platforms to help you see what’s out there. This list covers a range of solutions, from institutional-grade forex automation to user-friendly crypto bots, giving you a clear picture of the best tools available for every type of trader.

FN Capital’s FAST AI

FN Capital is designed for investors who want institutional-grade performance without the complexity of manual trading. Its proprietary FAST AI algorithm focuses exclusively on the EUR/USD forex pair, the most liquid market in the world. This specialization allows the AI to execute thousands of trades with precision, minimizing slippage and optimizing for consistent returns. What truly sets it apart is its transparency; FN Capital provides a 4-year verified track record on FX Blue, showing real-world results. It’s a fully automated, hands-off solution backed by a dynamic risk management tool, making it an excellent choice for both accredited investors and those seeking a reliable passive income stream from the forex market.

Trade Ideas

Trade Ideas is a powerful tool for active stock traders. Its strength lies in its AI-powered market scanner, which sifts through thousands of US stocks in real time to find high-probability opportunities. The platform offers three distinct AI trading bots that run different strategies, allowing you to see what the AI is trading and why. Instead of just executing trades for you, Trade Ideas acts as a sophisticated co-pilot, delivering a constant stream of data-driven ideas. It’s ideal for day traders and swing traders who want to leverage AI for discovery and analysis but still maintain control over their final trading decisions.

StockHero

StockHero is a great entry point for anyone interested in automated crypto trading. It’s known for its user-friendly interface and a marketplace full of pre-built trading bots. You can pick a bot based on its historical performance and connect it to your preferred crypto exchange in minutes. For those who want to test the waters without risking capital, StockHero offers a paper trading feature that lets you simulate trades with fake money. It’s a straightforward platform that removes much of the technical barrier to entry, making it a solid choice for beginners looking to automate their crypto strategies.

TrendSpider

TrendSpider is built for the serious technical analyst who wants to supercharge their charting process. The platform uses AI to automate the drawing of trendlines, Fibonacci retracements, and the recognition of candlestick patterns, saving you hours of manual work. Its standout feature is the ability to backtest strategies without writing a single line of code. You can build a trading strategy based on technical indicators and instantly see how it would have performed on historical data. TrendSpider is less about hands-off execution and more about giving traders AI-powered tools to build and validate their own unique strategies with incredible speed and accuracy.

Incite AI

Incite AI serves as an intelligent research assistant for both stock and cryptocurrency investors. Rather than focusing on automated execution, the platform uses AI to analyze real-time data and deliver clear insights and predictions. It helps you understand market sentiment, identify trends, and evaluate potential investments before you commit. Think of it as a data science team in your pocket. Incite AI is best for investors who do their own due diligence but want an AI-powered edge to make more informed decisions. It bridges the gap between raw data and actionable intelligence for a modern approach to portfolio management.

Jarvis Invest

Focused specifically on India’s National Stock Exchange (NSE), Jarvis Invest is an AI-powered advisory platform. It analyzes an enormous amount of data—over 300 million data points daily—to generate stock recommendations for both short-term and long-term portfolios. The platform claims a high accuracy rate and provides a risk management tool that helps you create a balanced portfolio based on your risk appetite. Jarvis Invest is not a trading bot but a suggestion engine, making it suitable for investors in the Indian market who are looking for AI-driven guidance on which stocks to buy and sell.

Cryptohopper

Cryptohopper is one of the most established and popular platforms for automated cryptocurrency trading. It offers a wide range of tools, including automated trading bots, social trading features, and a strategy designer. You can let your bot trade 24/7 on your favorite crypto exchange, copy the strategies of more experienced traders, or build your own custom strategy using its drag-and-drop interface. Cryptohopper supports a huge number of exchanges and is known for its reliability, making it a go-to choice for both new and experienced crypto traders who want a powerful and versatile automation tool.

3Commas

3Commas is another leading platform in the crypto trading bot space, celebrated for its user-friendly design and powerful features. It’s particularly famous for its signature bots, including the DCA (Dollar-Cost Averaging) Bot, which helps you automate a steady investment strategy, and the Grid Bot, which is designed to profit from market volatility. The platform supports a wide array of cryptocurrency exchanges and offers a clean, intuitive dashboard that makes it easy to manage your automated strategies. With its strong community and educational resources, 3Commas is an excellent all-around choice for anyone looking to automate their crypto trading.

How AI Trading Platforms Are Priced

Finding the right AI trading platform means looking at more than just features—you also have to understand how it’s priced. The cost can tell you a lot about who the tool is for and what level of service you can expect. Most platforms use a few common pricing structures, from simple monthly fees to one-time licenses. Knowing the difference will help you find a solution that fits your budget and your trading goals without any surprise fees down the road. It’s all about finding a transparent model that aligns with the value you expect to receive.

Monthly or Annual Subscriptions

This is the most popular pricing model you’ll come across, working just like your other favorite subscriptions. You pay a recurring fee, usually monthly or annually, for access to the platform. Companies like StockHero and TrendSpider use this model, often providing different tiers with varying levels of features. A basic plan might be perfect for a newcomer, while a premium tier could offer advanced analytics for a seasoned trader. Choosing an annual plan can often save you some money with a nice discount. These subscriptions typically bundle everything you need: the software itself, regular updates, and access to customer support. At FN Capital, we offer clear license options that give you full access to our FAST AI algorithm without complicated tiers.

One-Time Software Licenses

While less common these days, some providers offer a one-time license fee. With this model, you pay a larger sum upfront for lifetime access to a specific version of the software. This can be appealing if you prefer a single payment over a recurring one. However, it’s important to read the fine print. This model often applies to downloadable AI trading software that you install on your own machine. The potential catch is that future updates, new features, or dedicated support might require additional payments. If the market evolves—and it always does—you want to make sure your tool can evolve with it. Always clarify what “lifetime access” truly includes before committing.

Freemium Tiers

The freemium model is a great entry point for anyone curious about AI trading but not ready to commit financially. Platforms with a freemium tier offer a basic version of their service for free, with the option to upgrade for more powerful features. This lets you get a feel for the user interface, test the core functionality, and see if the platform is a good fit for your style. Just keep in mind that free versions usually have limitations. You might face restrictions on the number of trades, access to certain indicators, or the speed of data analysis. Many online brokers are also beginning to integrate free AI tools into their existing platforms, giving you another way to experiment without an initial investment.

Hidden Costs to Watch For

A platform’s sticker price isn’t always the full story. To avoid surprises, it’s smart to look out for potential hidden costs that can add up over time. For example, some platforms charge extra for premium, real-time data feeds, which are essential for making accurate trading decisions. Without them, you could be trading on delayed information, putting you at a significant disadvantage. Other costs might include fees for connecting to specific exchanges or charges for using proprietary indicators. According to Forbes, the high cost of quality data and advanced tools can create a disadvantage for retail traders. That’s why we believe in transparency. With FN Capital, our pricing is straightforward, and our 100-day money-back guarantee ensures you can verify our performance risk-free.

Pros and Cons of Top AI Trading Tools

Every AI trading platform comes with its own set of strengths and weaknesses. There’s no single “perfect” tool, because the right choice depends entirely on your trading style, experience level, and financial goals. A platform that’s ideal for a hands-off investor seeking passive income might not be the best fit for an active day trader who wants deep customization. The key is to find the tool that aligns with what you want to achieve.

To help you make an informed decision, let’s break down some of the most popular AI trading tools on the market. We’ll look at what makes each one stand out and where it might fall short. Understanding both sides of the coin is the first step toward choosing a platform you can trust with your capital. Think of this as a guide to matching your needs with the right technology, so you can feel confident in the investment analysis tools you use.

FN Capital’s FAST AI

FN Capital’s FAST AI is built for consistency and hands-off performance. Its biggest strength is its proven, four-year verified track record, which gives you a transparent look at its historical performance. The system’s laser focus on the EUR/USD pair means it operates in the world’s most liquid market, reducing slippage and execution delays. With AI now driving a huge portion of global trading volume, FAST AI is designed to capitalize on this trend for you.

The main consideration here is the nature of full automation. Because the system is entirely AI-driven, it removes human emotion and bias from the equation. However, this also means it won’t account for unique, nuanced market events that might benefit from a human touch. It’s a trade-off for a completely automated, data-driven approach.

Trade Ideas

Trade Ideas is a powerhouse for active traders who love data. It’s known for its sophisticated AI bots that scan the US stock market in real-time, hunting for opportunities. The platform excels at algorithmic trading and offers a wealth of features for building and testing strategies. If you’re an experienced trader who wants to get under the hood and fine-tune your approach, Trade Ideas provides the tools to do it.

That said, its complexity can be a double-edged sword. For a beginner, the sheer number of features and data points can feel overwhelming. This platform is best suited for traders who are already familiar with algorithmic concepts and are prepared to invest time in learning the software to get the most out of its advanced capabilities.

StockHero

StockHero’s main appeal is its flexibility. It gives you the choice to either build your own trading bot from scratch or rent a pre-configured one from its marketplace. This makes it a great middle-ground for traders who want some control without having to code everything themselves. It also integrates with several popular brokers, making it easy to connect your existing accounts. The user-friendly interface is another plus, simplifying the process of launching and monitoring your bots.

The downside is that performance can be inconsistent. Because the platform relies on bots from a marketplace, their effectiveness varies. You’ll need to do your homework to find a reliable strategy or spend time tweaking your own. Success on StockHero often depends on your ability to optimize your trading strategies effectively.

TrendSpider

If you’re a technical analyst, TrendSpider might feel like it was built just for you. The platform is packed with impressive features, including world-class AI pattern recognition, automated trendlines, and powerful, code-free backtesting. It’s designed to automate the tedious parts of chart analysis, allowing you to spot patterns and opportunities much faster. Its unique tools can give you a serious edge in understanding market movements.

However, all that power comes with a learning curve. TrendSpider is a feature-rich environment, and its advanced tools may be intimidating for traders who aren’t deeply versed in technical analysis. While incredibly useful, it’s a platform that requires some dedication to master, making it one of the top AI stock trading tools for serious chartists.

Incite AI

Incite AI positions itself as a powerful research assistant, using AI to quickly analyze massive amounts of market information for both stocks and crypto. Its primary goal is to deliver actionable insights that help you make smarter, less emotional decisions. By processing data faster than a human ever could, it aims to give you a clearer picture of the market and potential opportunities.

The main thing to keep in mind is that Incite AI is an insights platform, not a fully automated trading bot. It provides analysis and suggestions, but the final decision to trade rests with you. This means you can’t just set it and forget it. It’s a tool to enhance your own research, not replace it, so a healthy dose of due diligence is still required.

Jarvis Invest

Jarvis Invest focuses on building customized investment portfolios. The platform uses AI to analyze market data and suggest stocks for both short-term and long-term goals, claiming a high accuracy rate. One of its key features is its ability to create a portfolio tailored to your specific risk tolerance, complete with 24/7 risk management to protect your investments.

While the idea of a custom, AI-managed portfolio is appealing, it’s wise to be realistic about performance claims. An advertised accuracy rate may not hold up during extreme market volatility. As with any investment tool, past performance is not a guarantee of future results, so it’s important to use Jarvis Invest with a clear understanding of the risks involved, especially in unpredictable markets.

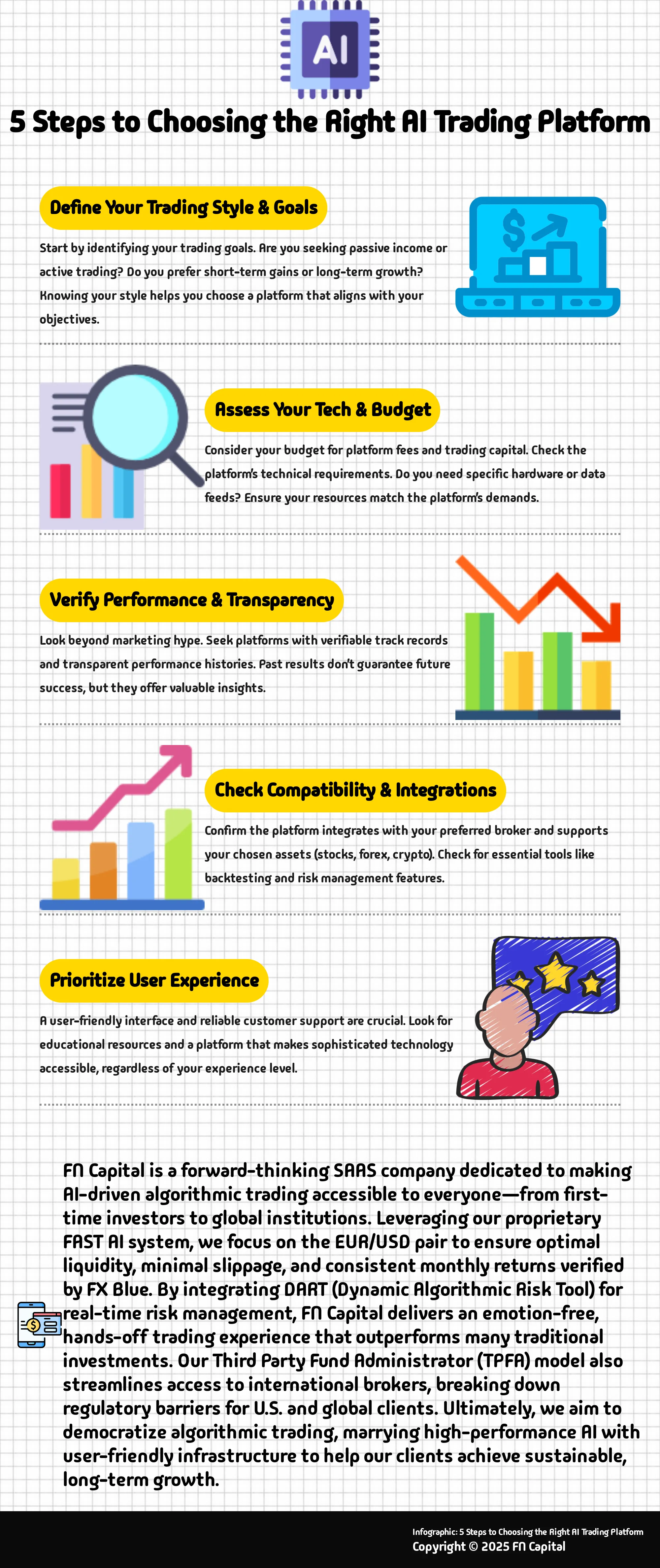

How to Choose the Right AI Trading Platform for You

Choosing the right AI trading platform is a lot like picking a business partner. You need to find one that aligns with your style, has the right skills, and that you can trust to get the job done. With so many options out there, here’s a straightforward guide to help you find the perfect match for your trading journey.

Define Your Trading Style and Goals

First, think about what you want to achieve. Are you looking for a hands-off way to generate passive income, or are you an active trader who wants an AI assistant to find opportunities? Your personal goals are the most important factor. Some platforms are designed for beginners, offering simple, automated solutions. Others provide complex tools for seasoned professionals who want to fine-tune every detail. The best AI-driven strategies can serve both, but you need to know which camp you fall into. Before you even look at features, get clear on your “why.” This will help you filter out the noise and focus on the tools that truly align with your financial objectives.

Check the Technical Requirements

Not all AI is created equal. The engine running your trading platform determines its power and precision. Look for systems built on high-quality data, sophisticated algorithms, and real-time analysis. After all, AI now drives a huge portion of global trading, so the technology matters. Some platforms may require you to have powerful hardware or access to expensive data feeds. Others, like FN Capital, provide a fully managed solution where the complex quantitative trading infrastructure is handled for you. Make sure you understand what the platform requires from you and what it delivers in terms of speed, accuracy, and analytical depth. A powerful AI should simplify your process, not complicate it.

Weigh Your Budget Against Potential Returns

AI trading platforms come with different price tags, from monthly subscriptions to one-time license fees. It’s easy to get sticker shock, but it’s better to think in terms of value. A higher price often reflects more advanced technology, better data, and more robust risk management tools. The key is to weigh the cost against the potential for returns. Look for platforms with a transparent, publicly verified track record. This historical performance is your best indicator of what the AI can do. While past results don’t guarantee future earnings, they provide a solid baseline for what you can expect from your investment. You can also check out a platform’s pricing page to see how its features align with its cost.

Confirm Compatibility and Integrations

Finally, make sure the platform plays well with your existing setup. Does it integrate with your preferred broker? Does it trade the assets you’re interested in, whether that’s forex, stocks, or crypto? The best AI tools should fit seamlessly into your workflow. For example, FN Capital uses a Third Party Fund Administrator (TPFA) structure to give clients access to top-tier international brokers, solving a common compatibility issue for U.S. investors. Look for extra features like built-in risk mitigation tools and backtesting capabilities. A platform that works with you and for you is one that will support your trading journey for the long haul.

How AI Can Affect Your Trading Performance

Integrating AI into your trading strategy isn’t just about keeping up with technology; it’s about fundamentally changing how you approach the markets. An AI platform can give you a significant edge by improving your decision-making, risk management, and overall efficiency. Here’s a closer look at how.

Sharper, Data-Driven Decisions

Humans are great, but we can’t process millions of data points in a millisecond. AI can. It sifts through massive amounts of market data—from price action and news sentiment to economic indicators—to spot patterns and opportunities that are invisible to the naked eye. This is why AI-powered systems are so effective at making sharp, logical trading choices. Instead of relying on a hunch, the AI uses complex algorithms to predict price movements based on pure data. This data-first approach allows for a more objective and calculated strategy, moving you from guessing to knowing.

Smarter Risk Management

Successful trading is as much about protecting your capital as it is about growing it. AI excels at this by implementing dynamic risk controls that react instantly to market changes. Think of it as a vigilant co-pilot that never sleeps. It can automatically adjust your position sizes, set intelligent stop-losses, and manage your overall exposure based on real-time volatility. This brings a level of sophistication to your portfolio that was once reserved for large financial institutions. By using these advanced risk management techniques, you can better protect your account from unexpected downturns and trade with greater confidence.

Greater Efficiency

The market moves fast, and opportunities can vanish in the blink of an eye. AI gives you the speed you need to act on them. It can monitor multiple markets and execute trades 24/5, all in a fraction of a second. This means you don’t have to be glued to your screen all day. The AI handles the heavy lifting of constant analysis and order placement, freeing you up to focus on your broader strategy. This technology has completely transformed the quality and speed of data analysis, allowing for near-instantaneous trend detection and trade execution that a human trader simply can’t match.

Removing Emotion from Trades

Let’s be honest: fear and greed are two of the biggest obstacles to consistent trading profits. We’ve all been there—panicking during a dip or getting too optimistic during a rally. AI removes this emotional rollercoaster from the equation entirely. It operates based on a strict set of rules and statistical probabilities, executing trades with cold, hard logic. It doesn’t get nervous or overconfident. This disciplined approach is key to long-term success, as it prevents impulsive decisions that can wreck a portfolio. By sticking to a proven strategy, an AI system provides the kind of consistent risk mitigation that is essential for sustainable growth.

What to Consider About User Experience

Beyond the core features, the overall user experience can make or break your success with an AI trading platform. A powerful algorithm is only useful if you can interact with it effectively and trust its performance. The best platforms are designed with the user in mind, ensuring that everything from performance metrics to customer support is clear, accessible, and reliable. When you’re evaluating your options, pay close attention to how a platform presents its data, supports its users, and makes its technology available to traders of all skill levels. These elements are just as important as the underlying code.

Verified Performance and Success Rates

Trust is everything in trading, and you shouldn’t have to take a platform’s claims at face value. Look for providers that offer transparent, publicly verifiable track records. While past performance doesn’t guarantee future results, it’s the clearest indicator of a strategy’s historical effectiveness and consistency. A platform that openly shares its success rates, win percentages, and drawdown history shows confidence in its system. For example, FN Capital provides a live 4-year track record on FX Blue, allowing you to see exactly how our FAST AI has performed over time. This level of transparency is a critical part of the user experience, giving you the data you need to feel secure.

Ease of Use and Accessibility

The best AI trading tools are no longer reserved for large institutions. Modern platforms are designed to be accessible to everyone, from beginners seeking passive income to experienced traders looking to diversify. A great user experience means you don’t need a degree in quantitative finance to get started. The interface should be intuitive, the setup process should be straightforward, and the day-to-day operation should be hands-free. The goal is to democratize access to institutional-grade technology, allowing you to benefit from sophisticated algorithms without a steep learning curve. A platform should feel less like a complex piece of software and more like a reliable partner working for you.

Customer Support and Educational Resources

Even with a fully automated system, you’ll want to know that help is available when you need it. Strong customer support and comprehensive educational resources are hallmarks of a user-focused platform. Before committing, check what kind of support is offered—whether it’s live chat, email, or phone. It’s also helpful to see if the platform provides clear documentation, tutorials, or insights into its trading philosophy. At FN Capital, we back our technology with a 100-day money-back guarantee and dedicated support to ensure you feel confident from day one. A platform that invests in educating and supporting its users is one that is committed to your long-term success.

What’s Next for AI in Trading?

AI in trading isn’t just a passing trend—it’s a fundamental shift in how investors approach the markets. With the AI trading market projected to hit $35 billion by 2030, it’s clear that automated, data-driven strategies are becoming the new standard. This growth is fueled by an increasing demand for smarter, faster, and more reliable ways to execute trades. The future isn’t about whether AI will be used in trading, but how it will continue to evolve and reshape the landscape for everyone involved.

One of the most significant changes on the horizon is the continued democratization of finance. For a long time, the most powerful analytical tools were reserved for large hedge funds and institutional players. Now, AI-driven strategies are bringing institutional-grade insights directly to individual investors. This levels the playing field, allowing anyone to make decisions based on the same high-quality data analysis that was once out of reach. As the technology becomes more accessible, it empowers more people to build wealth with tools that work for them, not against them.

Looking ahead, the technology itself is only getting more sophisticated. We’re seeing advancements in deep learning and natural language processing (NLP) that will allow AI to understand market sentiment from news and social media in real time. While access to high-quality data and advanced bots and automated tools can still be a hurdle, platforms that integrate these capabilities seamlessly will give their users a distinct advantage. The future of AI trading points toward systems that are not only automated but also adaptive, learning and refining their strategies as market conditions change. This means more efficiency, better performance, and a smarter way to trade.

Related Articles

- How AI Trading Works: Strategies & Benefits – FN Capital – Like a Cash Account, But Smarter

- AI Trading Algorithms: Your Practical Guide – FN Capital – Like a Cash Account, But Smarter

- Enhance Your Trading Strategy with Automated Trading Systems

- Real-World Algorithmic Trading Examples & Strategies

- Algorithmic Trading: The Ultimate Guide – FN Capital – Like a Cash Account, But Smarter

Frequently Asked Questions

Do I need trading experience to get started with AI trading? Not at all. While some platforms are built for seasoned traders who want to customize complex strategies, many of the best AI tools are designed specifically for beginners. Fully automated systems, like FN Capital, handle all the analysis and execution for you. The goal of this technology is to make sophisticated trading accessible, so you can benefit from a data-driven strategy without needing to know how to read charts or code algorithms yourself.

Are these platforms truly “set-it-and-forget-it,” or do I need to monitor them constantly? This really depends on the platform you choose. Some tools are designed to be co-pilots, providing you with data and trade ideas that you must act on yourself. However, other systems are built for full automation. A truly hands-off platform will manage everything from identifying opportunities to executing trades and managing risk, 24/5. This allows you to step back completely while the AI works on your behalf, which is ideal for anyone seeking a more passive approach to the markets.

How do AI platforms handle risk, especially during unexpected market events? This is one of the most important functions of a top-tier AI. The best platforms don’t just use a simple stop-loss; they have dynamic risk management systems built directly into their core logic. This means the AI is constantly analyzing market volatility and can automatically adjust position sizes or tighten its protective stops in real time. It’s designed to protect your capital by reacting to changing conditions with logic and speed, rather than emotion.

Besides the platform’s fee, what other costs should I be aware of when I start? It’s smart to think about the total picture. Beyond the platform’s subscription or license fee, you will need capital to fund your trading account, as this is the money the AI will actually use to trade. You should also check if your connected broker charges any commissions or fees per trade. A transparent platform will be upfront about its own costs, but always remember to account for your initial trading investment and any potential broker fees.

I already know a bit about trading. Why should I use an AI platform instead of just applying the strategies myself? The primary advantages are speed, scale, and discipline. Even if you have a winning strategy, you can’t analyze millions of data points in a fraction of a second or monitor the market 24 hours a day. An AI can. It executes trades with a level of speed and precision that’s impossible to replicate manually. More importantly, it removes emotion from the equation. The AI sticks to its programming and never makes an impulsive decision based on fear or greed, which is often the biggest hurdle for even experienced human traders.