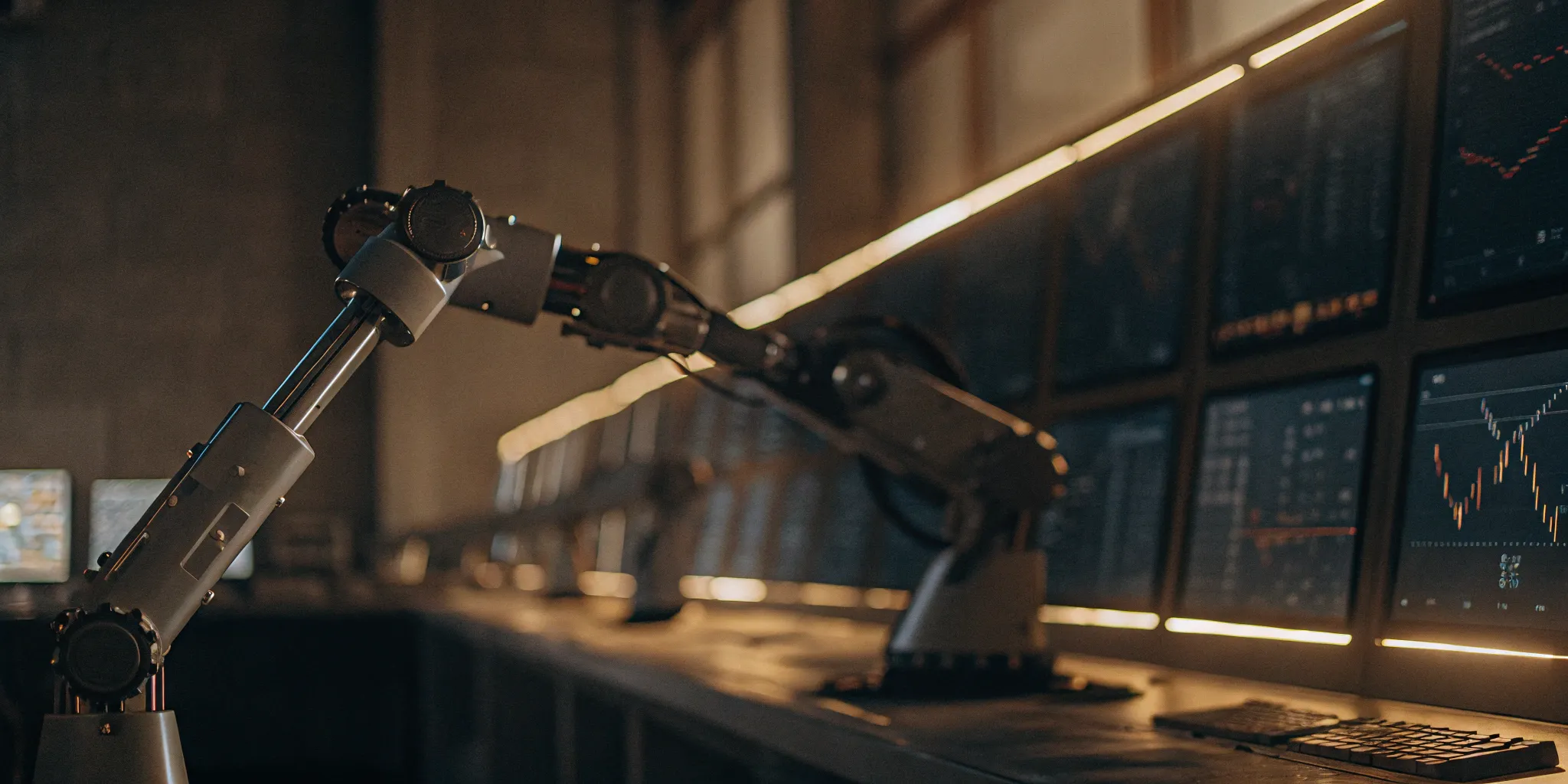

Not long ago, the most powerful trading tools were locked away in the towers of Wall Street, accessible only to hedge funds and large financial institutions. Today, technology has changed the game. Artificial intelligence has made it possible for individual investors to access the same level of sophisticated, data-driven execution that was once reserved for the pros. This isn’t about simple stock alerts; it’s about using fully automated systems that can analyze the market and execute trades with incredible speed and precision. This guide is designed to show you how to harness that power. We’ll break down what makes these platforms work and help you find the best trading AI platform to bring institutional-grade technology to your personal portfolio.

Key Takeaways

- Look for Proof, Not Just Promises: A great AI platform backs up its claims with a transparent, publicly verified track record. Before committing, always check for live performance data from a third party to ensure the system delivers consistent, real-world results.

- Use AI to Remove Emotion and Save Time: The biggest advantage of AI is its ability to trade with speed and discipline, free from human emotions like fear or greed. It automates the most time-consuming parts of trading and helps you stick to a logical, data-driven strategy.

- Find a Platform That Fits Your Needs: Not all AI platforms are the same. Decide if you want a fully automated, hands-off system for passive income or an AI-powered assistant for active trading, and then choose a tool with features that match your personal goals.

What Exactly Is an AI Trading Platform?

So, what exactly is an AI trading platform? Think of it as a sophisticated software that uses artificial intelligence to make trading decisions. Instead of you manually staring at charts for hours, these platforms use powerful technologies like machine learning to sift through massive amounts of market data. We’re talking about everything from price movements and trading volumes to news headlines and even social media chatter. The AI is trained to spot patterns and opportunities that would be nearly impossible for a human to catch in real-time.

Once the AI identifies a potential trade, it can do a few things. Some platforms will send you a signal or a recommendation, leaving the final decision up to you. Others, like our FAST AI system, go a step further and fully automate trading strategies, executing buy and sell orders on your behalf. The goal is to remove the guesswork and emotional decision-making that often trips up traders, allowing for faster, more data-driven execution. By handling the heavy lifting of market analysis and trade execution, these platforms act as powerful tools for both new investors and seasoned pros. They help you stay disciplined, react instantly to market changes, and base your strategy on pure data, not gut feelings.

What Makes a Great AI Trading Platform?

When you’re looking for an AI trading platform, it’s easy to get lost in a sea of technical jargon and flashy promises. So, what really separates a powerful, reliable tool from a simple gimmick? It’s not just about having “AI” in the name; it’s about how that artificial intelligence is put to work for you in a smart, transparent, and secure way. A truly great platform is built on a foundation of several key pillars that work together to create a cohesive and effective trading system. Think of it as a checklist for finding a platform that you can actually trust with your capital.

First, you need genuine automation that goes beyond simple alerts. The system should be able to execute trades on its own, removing the guesswork and emotional stress from the equation. Next, it needs the power to analyze the market instantly, spotting opportunities that would be impossible for a human to catch. But finding opportunities is useless without protecting your investment. That’s why robust, built-in risk management is non-negotiable. And of course, you need proof. Any platform can make claims, but the best ones back it up with a transparent, verified track record. Finally, all of this needs to connect seamlessly with a reliable broker to ensure your trades are executed efficiently. These are the core components that define a top-tier AI trading platform.

Truly Automated Algorithms

A top-tier AI platform offers more than just alerts or suggestions—it provides truly automated algorithms that can execute trades on your behalf. This means the system doesn’t just spot an opportunity; it acts on it based on its programming, removing the emotional decision-making that can often lead to mistakes. The goal is a hands-free experience where the AI handles the complex work of market timing and execution. These systems are designed to operate 24/5, constantly scanning for high-probability setups so you don’t have to be glued to your screen. This level of quantitative trading was once only available to large institutions, but now it’s accessible to individual investors looking for a smarter way to participate in the markets.

Instant Market Analysis

The financial markets generate an overwhelming amount of data every second. No human can possibly keep up. This is where AI shines. A great platform uses machine learning and other advanced technologies to perform instant market analysis, processing news, price action, and economic indicators in real time. It can identify patterns and correlations that are invisible to the human eye, giving you an edge. Instead of spending hours on research, you can rely on the AI to sift through the noise and deliver actionable insights. This ability to leverage big data in investing is what allows the platform to adapt quickly to changing market conditions and find opportunities as they emerge.

Smart Risk Management Tools

Making money is only half the battle; protecting your capital is just as important. A reliable AI trading platform will have smart risk management tools built directly into its core programming. This isn’t just a simple stop-loss order. Look for dynamic systems that can adjust position sizes, manage leverage, and set maximum drawdown limits based on real-time market volatility. For example, FN Capital’s DART (Dynamic Algorithmic Risk Tool) continuously optimizes exposure to protect your account. Effective risk mitigation ensures that the AI is programmed not just for profit, but for long-term preservation of your investment, helping you stay in the game even during unpredictable market swings.

Verified Performance and Backtesting

Anyone can claim their algorithm is profitable, but a great platform provides proof. This comes in two forms: backtesting and a verified track record. Backtesting shows how a strategy would have performed on historical data, which helps validate its logic. Even more important is a live, publicly verified track record from a trusted third-party source. This shows you exactly how the AI has performed in real market conditions with real money. For instance, you can view FN Capital’s live performance on FX Blue, which details years of trading history. This transparency is non-negotiable; it builds trust and gives you the confidence that the platform can actually deliver on its promises.

Flexible Broker Integration

Your AI trading platform is the brain, but your broker is the body that executes the trades. A great platform offers seamless and flexible integration with reputable brokers. This ensures that trades are executed quickly and at the best possible prices, which is critical for performance. Some platforms, like FN Capital, even offer unique solutions for asset management by using Third Party Fund Administrators (TPFAs). This structure allows clients to access internationally regulated brokers with better trading conditions, which might otherwise be unavailable. This flexibility ensures your capital is handled within a secure and efficient framework, giving you peace of mind while the AI goes to work.

The Top 7 AI Trading Platforms We Recommend

Now that you know what to look for, let’s explore some of the best AI trading platforms available. Each one offers a unique approach, from fully automated systems to powerful analytical tools that support your own strategies. As you read through this list, think about your personal trading style, your level of experience, and what you hope to achieve. This will help you find the platform that feels like the right fit for your financial goals.

1. FN Capital

FN Capital is designed for investors who want a truly hands-off, institutional-grade trading solution. Its proprietary FAST AI algorithm focuses exclusively on the EUR/USD pair, leveraging its high liquidity to execute thousands of trades with precision. What really sets it apart is its transparency; you can see a 4-year verified track record on FX Blue, showing consistent performance and a 7.5%+ average monthly return. The system includes a Dynamic Algorithmic Risk Tool (DART) for real-time risk mitigation, automatically adjusting to market conditions to protect your capital. It’s an excellent choice for both new investors seeking passive income and seasoned professionals who want to add a proven quantitative strategy to their portfolio. Plus, they offer a 100-day money-back guarantee, so you can see the results for yourself without the risk.

2. Trade Ideas

If you’re an active day trader who thrives on real-time data, Trade Ideas is a platform to consider. It’s best known for its AI engine, “Holly,” which scans the market and generates trade signals throughout the day. Instead of executing trades for you, Holly provides you with statistical probabilities and entry and exit points, which you can then act on. It’s less of a “set-it-and-forget-it” system and more of an AI-powered assistant that helps you spot opportunities you might have otherwise missed. This makes it a great tool for hands-on traders who want to maintain full control over their decisions but want to use AI to sharpen their edge.

3. TrendSpider

TrendSpider is built for technical analysts who love charts and patterns. The platform uses AI to automate the process of drawing trendlines, identifying Fibonacci retracements, and recognizing candlestick patterns. This saves a massive amount of time and helps remove personal bias from your analysis. It also offers advanced backtesting capabilities, allowing you to test your strategies against historical data before putting real money on the line. While it does offer auto-trading through its Signal Drops and Trading Bots feature, its core strength lies in enhancing and automating technical analysis for traders who already have a specific methodology.

4. Tickeron

Tickeron is a comprehensive platform that uses AI for deep stock market analysis and idea generation. It offers a suite of tools, including an AI-powered “Pattern Search Engine” that finds chart patterns for you and an “AI Robots” feature that provides ongoing trade ideas with stated win rates. Tickeron is particularly useful for traders who want AI to do the heavy lifting on research. Instead of a single algorithm, it offers various specialized AI tools you can use to analyze different assets and build a diversified portfolio. It’s a solid choice for those who want AI-driven insights to inform their trading decisions rather than a fully autonomous system.

5. Alpaca

Alpaca is a unique platform geared toward developers and tech-savvy traders who want to build their own automated trading strategies from the ground up. It offers a commission-free trading API that lets you connect your custom algorithms directly to the market. This isn’t a platform with a pre-built AI; instead, it provides the infrastructure for you to run your own. If you know how to code (or are willing to learn) and have a specific trading idea you want to automate, Alpaca gives you the tools to do it. It’s the ultimate DIY solution for traders who want complete control over their algorithmic logic.

6. Kavout

Kavout is another platform that uses AI to provide market analysis and stock ratings. Its flagship feature is the “K-Score,” a predictive rating that analyzes a massive amount of data to rank stocks on their likelihood of outperforming the market. You can use this score to find new investment ideas or to validate your own research. Kavout is essentially an AI-driven research assistant that helps you sift through the noise and focus on stocks with strong potential. It’s best for investors who prefer to make their own trading decisions but want to incorporate machine learning insights into their process for a smarter, data-driven approach.

7. StockHero

StockHero offers a great middle ground for traders who want to get into bot trading without needing to code. The platform features a user-friendly interface where you can create your own trading bots using pre-defined rules and technical indicators. If you don’t want to build your own, you can rent successful bots from its marketplace, allowing you to leverage strategies created by other experienced traders. StockHero integrates with multiple major crypto and stock exchanges, making it a flexible option for automating your trades across different platforms. It’s a strong choice for beginners and intermediate traders who want to experiment with automation in a controlled environment.

How AI Trading Makes You a More Efficient Trader

AI trading isn’t about replacing you; it’s about giving you a serious edge. Think about all the time you spend staring at charts, trying to spot the perfect entry point, or second-guessing a decision after the fact. AI handles the heavy lifting, making you a smarter and far more efficient trader by taking over the most repetitive and emotionally draining tasks.

First, AI automates the most time-consuming parts of trading. Instead of manually performing technical analysis for hours, AI algorithms can process massive amounts of market data in seconds. They identify patterns and potential trades based on a pre-defined strategy, freeing you from constant screen time. This automation of technical analysis means you can focus on your overall strategy instead of getting lost in the noise of minor market movements.

Next is the sheer speed. In markets that move in a blink, a few seconds can make all the difference between profit and loss. AI systems execute trades in milliseconds, a speed no human can possibly match. This precision ensures you get in and out of positions at the optimal price, minimizing slippage and maximizing opportunities. Plus, AI is always on. It can continuously monitor market conditions around the clock, reacting to news or price shifts while you’re asleep or at your day job.

Perhaps most importantly, AI removes emotion from the equation. Fear of missing out (FOMO) and panic-selling are two of the biggest hurdles for traders. An AI like FN Capital’s FAST AI operates purely on data and logic. It sticks to the plan without greed or fear, leading to more disciplined and consistent trading. This allows you to step back and manage your portfolio with a clear head, turning trading from a stressful activity into a streamlined process.

Breaking Down the Costs: How Platforms Are Priced

When you start looking at AI trading platforms, you’ll notice that pricing is all over the map. The cost often reflects the sophistication of the technology, the level of support you get, and the features included. Understanding these pricing models is the first step to finding a platform that fits your budget and your trading ambitions without any surprise expenses down the road.

Most companies in this space use a few common structures. Your job is to look past the sticker price and see what you’re truly getting for your money. Are you paying for raw tools that you have to configure yourself, or are you investing in a fully managed system with a proven track record? Let’s break down the typical costs you’ll encounter.

Subscription-Based Plans

The most common pricing model you’ll find is a monthly or annual subscription. These plans are often tiered, with costs increasing as you access more powerful features. For example, some platforms might charge around $100 per month for a basic plan, while their premium tiers with more advanced AI tools and analytics can run several hundred dollars per month. Companies like TrendSpider and Trade Ideas use this tiered approach, where higher payments grant access to more sophisticated AI stock trading tools.

These subscriptions typically cover the use of the software, but the level of automation and support can vary. A lower-tier plan might give you access to AI-driven scanners and alerts, but still require you to execute trades manually. Higher-priced plans may offer fully automated trading, dedicated support, and more extensive backtesting capabilities. Always check what’s included in each tier to make sure it aligns with your needs.

Trying Before You Buy: Demos and Trials

Committing to a new trading platform is a big decision, so you’ll want to test the waters first. Many services offer a free trial or a demo, giving you a chance to explore the interface and features before you pull out your credit card. These trials are a great way to see if a platform feels intuitive to you, but they are often too short to properly evaluate an AI’s actual trading performance. A seven-day trial isn’t enough time to see how an algorithm performs in different market conditions.

This is why a longer, risk-free evaluation period is so valuable. At FN Capital, we stand by our FAST AI’s performance with a 100-Day Money-Back Guarantee. This gives you more than three months to see real results and confirm that our system works for you, offering genuine peace of mind that a standard trial simply can’t match. It’s a commitment to transparency and a testament to our confidence in our technology.

Watch Out for These Hidden Fees

The subscription price isn’t always the final cost. Some platforms have additional fees that can catch you by surprise if you’re not looking for them. For instance, you might have to pay extra for real-time market data feeds, which are essential for any serious trading. Other platforms might charge for connecting to specific brokers or for using premium, pre-built trading bots.

Beyond direct costs, consider the indirect ones. Some platforms have a steep learning curve, requiring a significant time investment to learn how the AI trading software and its interface works. A system that is overly complex can feel like a hidden tax on your time and energy. Look for a platform with clear pricing and a straightforward setup, so you can focus on your investment goals instead of navigating a complicated system.

Ease of Use: What to Expect from the Interface

An AI trading platform can be incredibly powerful, but its features are only useful if you can actually figure out how to use them. The user interface is your command center, and its design can make or break your experience. The best platforms are built with a specific user in mind, whether you’re a complete beginner or a seasoned quantitative analyst. You shouldn’t need a degree in computer science to get started. A great interface feels intuitive, presenting complex data in a way that’s easy to digest.

When you’re evaluating a platform, pay close attention to the dashboard. Is it clean and organized, or cluttered and overwhelming? Look for clear data visualization, like performance charts and real-time profit/loss trackers. These tools help you understand what the AI is doing without having to sift through raw data logs. Ultimately, the goal is to find a platform that matches your comfort level with technology and trading. It should feel like a helpful assistant that simplifies your process, not another complex system you have to master. From guided onboarding to fully customizable developer APIs, the experience should align with your core solutions and goals.

Features for Newcomers

If you’re new to trading, you’ll want a platform that prioritizes simplicity and automation. Look for a “hands-off” experience where the heavy lifting is done for you. The best AI for beginners automates complex tasks like technical analysis and order execution, so you don’t have to spend months learning market theory. Instead of presenting you with endless charts and indicators, these platforms often provide pre-configured strategies based on a proven track record. Your main job is to set it up, fund your account, and let the AI work. FN Capital, for example, offers a completely hands-free AI trading system designed to deliver consistent results without requiring any manual intervention from you. The interface should be straightforward, with a simple dashboard to monitor performance.

Tools for the Pros

Experienced traders and institutions require a much deeper level of control and customization. If this is you, you’re not looking for a simple “on/off” switch. You need an interface that provides granular control over trading parameters, risk settings, and strategy implementation. Advanced platforms offer sophisticated tools like AI-powered pattern recognition, in-depth backtesting engines to test strategies against historical data, and real-time market scanners that hunt for specific opportunities. Many pros also look for API access to integrate the AI’s logic into their own custom-built systems. The focus here is on flexibility and data. You want access to the raw materials to build, test, and deploy highly specific quantitative trading strategies that align with your firm’s goals.

Trading On the Go: Mobile Access

In today’s market, you need to be able to monitor your investments from anywhere. A solid mobile experience is no longer a “nice-to-have”—it’s essential. Whether through a dedicated app or a mobile-responsive website, you should have access to your account’s core functions from your phone. This includes a clear, at-a-glance view of your portfolio’s performance, real-time profit and loss updates, and push notifications for important account activity. While most AI trading is automated, you’ll want the peace of mind that comes with being able to check in and see how things are running. A well-designed mobile interface makes it easy to create your account and monitor your AI’s performance, ensuring you’re always connected to your capital.

A Realistic Look at the Risks and Limitations

AI trading platforms are incredibly powerful, but they aren’t a crystal ball. It’s important to have a clear-eyed view of what they can and can’t do. Like any investment tool, they come with their own set of risks and limitations. Understanding these challenges is the first step to using AI effectively and responsibly. By knowing the potential hurdles, you can better evaluate how a platform like FN Capital is built to handle them, giving you more confidence in your trading strategy. Let’s walk through some of the key considerations you should keep in mind.

Handling Market Volatility

First things first: AI trading platforms are not a guarantee of profit. The market is dynamic, and sometimes, it can get chaotic. Unexpected global events or sudden economic shifts can cause rapid changes, and some AI systems may struggle to adapt to extreme volatility they haven’t encountered before. A solid AI platform needs a built-in plan for this. At FN Capital, our FAST AI is paired with a DART (Dynamic Algorithmic Risk Tool) that provides real-time risk mitigation. It’s designed to automatically adjust trade exposure and leverage based on current market conditions, acting as a crucial safeguard when things get unpredictable.

The Importance of Good Data

An AI is only as smart as the data it learns from. Think of it this way: you can’t make a gourmet meal with spoiled ingredients. AI trading software works by analyzing huge amounts of market data, news, and other information to inform its decisions. If that data is flawed, incomplete, or biased, the AI’s output will be, too. This is why the quality and scope of the data are so critical. We focus our FAST AI exclusively on the EUR/USD pair, the most liquid forex pair in the world. This ensures our system is fed a constant stream of high-quality, reliable data, which is essential for making smart big data in investing decisions.

The Risk of “Overfitting”

“Overfitting” is a term you might hear in the AI world. It happens when an AI algorithm becomes too tailored to historical data, performing well on past events but poorly on new, unseen market conditions. It’s like a student who memorizes the answers for a practice test but can’t solve new problems on the final exam. A well-designed AI needs to learn patterns, not just memorize events. We combat overfitting through continuous backtesting and forward-thinking financial models that are built to adapt to new market dynamics, ensuring our AI remains flexible and forward-looking.

Staying on the Right Side of Regulations

The financial world is governed by a complex web of rules, and the landscape for AI trading is constantly evolving. Traders must ensure their activities comply with financial regulations, which can vary significantly depending on where you live. For example, U.S. investors often face restrictions that limit their access to international brokers with higher leverage. We’ve structured FN Capital to handle this complexity for you. By using a Third Party Fund Administrator (TPFA), we provide a compliant and seamless way for clients to access global markets, removing the regulatory friction so you can focus on your investment goals while keeping up with global investment trends.

How to Choose the Right AI Trading Platform for You

Finding the right AI trading platform feels a lot like hiring a new team member. You need to know it’s reliable, capable, and a good fit for your specific needs before you hand over any responsibility. With so many options out there, it’s easy to get overwhelmed by technical jargon and flashy marketing promises. The key is to cut through the noise and follow a clear, structured process. This isn’t just about comparing features; it’s about finding a system that aligns with your financial goals, your risk tolerance, and your level of involvement.

Think of this as your due diligence. The right platform should work as a partner, executing a strategy with a level of speed and discipline that’s nearly impossible to replicate manually. It removes the emotional guesswork that can sabotage even the most well-thought-out trading plans. But to get to that point of trust, you have to do your homework. By breaking down your decision-making process into a few simple, actionable steps, you can confidently choose a tool that works for you, not against you. We’ll walk through how to define your goals, evaluate core features, assess the cost, and, most importantly, verify performance with real-world data.

Define Your Trading Goals

Before you look at a single platform, take a moment to clarify what you want to achieve. Are you looking for a completely hands-off way to generate passive income? Or are you an active trader who wants AI to help you spot opportunities faster? Your answer will guide your entire search. For example, if you’re just starting out, it’s often best to focus on a single asset or strategy to learn the ropes without getting overwhelmed. Platforms that specialize, like FN Capital’s focus on EUR/USD, can simplify the process. Defining your investment analysis goals first ensures you don’t pay for complex features you’ll never use or choose a system that requires more manual input than you’re willing to give.

Evaluate the Platform’s Features

Once you know your goals, you can start comparing features. Some platforms are built for deep technical analysis with AI-powered pattern recognition, while others focus on fully automated execution. Look for a system that aligns with your trading style. If you want automation, prioritize platforms with proven algorithms and robust, real-time risk mitigation tools that operate without your constant supervision. A user-friendly interface is also crucial—the last thing you want is to struggle with complicated software. The goal is to find a platform with a powerful engine under the hood and a simple, intuitive dashboard that gives you a clear view of your performance.

Consider Your Budget

AI trading platforms come with a variety of pricing models, most commonly monthly or annual subscriptions. Be sure to look for transparent pricing and read the fine print to avoid any hidden fees. While cost is an important factor, the cheapest option isn’t always the best value. Instead, think about the return on your investment. A slightly more expensive platform with a verified track record of consistent returns might be a much smarter choice in the long run. I always recommend looking for platforms that offer a trial period or a money-back guarantee. This shows the company is confident in its product and gives you a risk-free way to see if its pricing and license options are a good fit for you.

Read Reviews from Real Users

Marketing materials will always highlight a platform’s best qualities, but real user experiences and verified data tell the whole story. Don’t just take a company’s word for its performance—look for proof. The gold standard is a publicly verified, third-party track record, which provides an unbiased look at historical performance, including win rates, average returns, and drawdowns. Checking a platform’s live performance on FX Blue or similar verification sites is a non-negotiable step. This data-driven approach removes the guesswork and helps you see exactly how the AI performs in live market conditions, giving you the confidence you need to move forward.

What’s Next for AI in Trading?

The world of AI trading isn’t standing still; it’s getting smarter, faster, and more intuitive every day. The algorithms driving platforms today are just the beginning. As technology evolves, we can expect AI to move beyond executing trades and become a true partner in financial strategy. Future systems will likely use advanced machine learning to not just follow rules, but to learn from every market move, adapting their strategies in real time with even greater precision. This means more accurate predictions, quicker execution, and an even deeper understanding of complex market dynamics.

We’ll also see a move toward more personalized trading experiences. Imagine an AI that not only trades for you but also adapts to your specific risk tolerance and financial goals, offering insights tailored to your portfolio. The future of AI in trading will also bring enhanced risk management tools, allowing for incredibly precise controls that protect your capital from unexpected market volatility. At FN Capital, we’re already building this future with our DART system, which continuously optimizes risk exposure. The goal is to create a trading environment where powerful technology works seamlessly to support your financial journey, whether you’re just starting out or managing institutional assets.

Related Articles

- How AI Trading Works: Strategies & Benefits – FN Capital

- Fully Automated AI Trading: Grow Your Wealth with Software – FN Capital

- Automated Trading Returns: Strategies for Success

- Real-World Algorithmic Trading Examples & Strategies – FN Capital

- Understanding AI Trades: A Practical Guide for Investors – FN Capital

Frequently Asked Questions

I have zero trading experience. Can I really use a platform like this? Absolutely. In fact, systems like ours are designed specifically for people who don’t have the time or desire to learn complex market analysis. The entire point of a truly automated platform is that it handles the strategy and execution for you. Your role is simply to set up your account and monitor its performance. The AI does the heavy lifting, operating on pure data and logic, which removes the steep learning curve and emotional stress that often come with manual trading.

How can I be sure the performance numbers are real and not just marketing? This is one of the most important questions you can ask, and you should be skeptical of any platform that isn’t completely transparent. The best way to verify performance is through an independent, third-party source. For example, our entire four-year trading history is publicly available on FX Blue. This isn’t a report we created; it’s a live, verified feed that shows every trade, the win rate, and the monthly returns in real-time. This level of transparency is non-negotiable because it proves the system works in live market conditions, not just in theory.

When you say ‘hands-off,’ what do I actually have to do? “Hands-off” means you are not involved in the day-to-day trading decisions. The AI handles all the market analysis, trade entries, and exits for you, 24/5. Your involvement is focused on the setup and oversight. You’ll need to create your account, connect it through our partner administrator, and fund it. After that, your main task is simply to monitor your account’s progress through your dashboard whenever you wish. You don’t need to watch charts, read financial news, or approve trades.

Why does FN Capital only trade EUR/USD? Isn’t that limiting? It might seem limiting, but it’s actually a strategic decision focused on quality and stability. The EUR/USD is the most traded currency pair in the world, which means it has incredible liquidity. This high liquidity ensures that our AI can execute thousands of trades quickly and efficiently with minimal slippage—the difference between the expected price and the actual execution price. By specializing in one market, our FAST AI develops a deep, expert-level understanding of its behavior, which is more effective than trying to be a jack-of-all-trades across many different assets.

What happens if the AI loses money? What does the 100-day guarantee cover? It’s important to remember that all trading involves risk, and there will be losing trades and down periods. No system can win 100% of the time. Our platform is built with this reality in mind, using a dynamic risk tool called DART to protect your capital during volatile periods. The 100-Day Money-Back Guarantee is our commitment to you. If, after this evaluation period, you are not satisfied with the AI’s performance and results, we will provide a full refund of the platform license fee. It gives you a substantial amount of time to see the system work through different market cycles, risk-free.